Standard payroll deductions calculator

Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. This guide contains formulas to calculate.

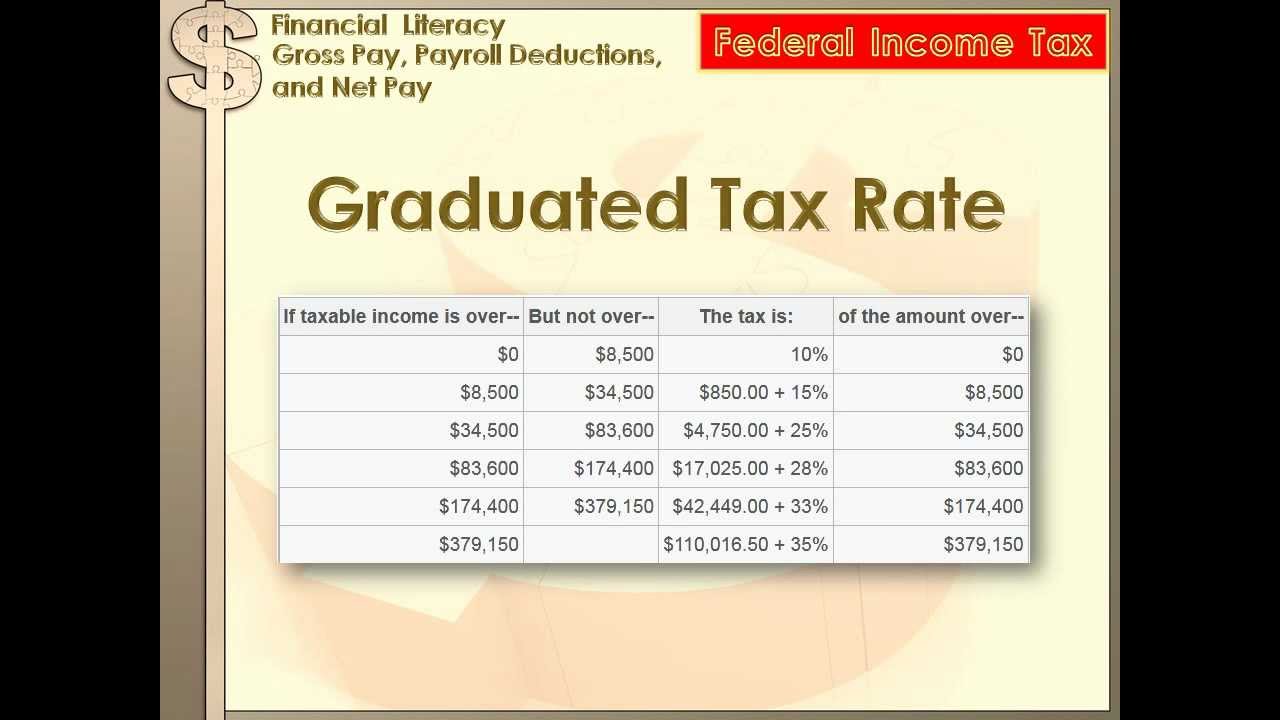

Financial Literacy Gross Pay Payroll Deductions Net Pay 8th Grade Math Youtube

2022 Federal income tax withholding calculation.

. Multiply taxable gross wages by the number of pay periods per year to compute your annual wage. The Tax Cuts and Jobs Act doubled the standard deduction to 12950 for single filers and 25900 for married filing jointly but completely eliminates personal exemptions. For example if you earn 2000week your annual income is calculated by.

Withholding schedules rules and rates are from IRS Publication 15 and IRS Publication 15T. Use this simplified payroll deductions calculator to help you determine your net paycheck. Payroll Deductions Online Calculator Use the Payroll Deductions Online Calculator PDOC to calculate federal provincial except for Quebec and territorial payroll deductions.

Our calculator will calculate gross pay. To calculate an annual salary multiply the gross pay before tax deductions by the number of pay periods per year. How to use a Payroll Online.

Total Non-Tax Deductions. For example if an employee earns 1500 per week the individuals annual. The standard deduction for tax year 2021 is 12550 for singles 25100 for joint filers and 18800 for heads of household.

Once you have a. Subtract 12900 for Married otherwise. Payroll Deductions Calculator Use this calculator to help you determine the impact of changing your payroll deductions.

Lets break down how it works. Form TD1-IN Determination of Exemption of an Indians Employment Income. Form TD1X Statement of Commission Income and Expenses for Payroll Tax Deductions.

You can use the Tax Withholding. Income Tax formula for old tax regime Basic Allowances Deductions 12 IT Declarations Standard deduction Deductions. You can enter your current payroll information and deductions and then compare them to your.

Use this calculator to help you determine your net paycheck. The information you give your employer on Form W4. Calculate and deduct federal income tax using the employees W-4 form and IRS tax tables for that calendar year.

Paycheck Managers Free Payroll Calculator offers online payroll tax deduction calculation federal income tax withheld pay stubs and more. To figure out your California payroll withholding and federal payroll taxes just enter wage and W-4 allowances for each employee below. Rules for calculating payroll taxes.

For help with your withholding you may use the Tax Withholding Estimator. Use this calculator to help you determine the impact of changing your payroll deductions. You can enter your current payroll information and deductions and.

Payroll Deductions Formulas T4127 You may want to use these formulas instead of the tables to calculate your employees payroll deductions. Withholding schedules rules and rates are from IRS Publication 15 and IRS Publication 15T. Taxes and deductions -000 Net pay 000 Start over This free hourly and salary paycheck calculator can estimate an employees net pay based on their taxes and withholdings.

To calculate your annual salary multiply the gross pay before taxes by the number of pay periods in the year. A payroll deductions online calculator lets you calculate federal provincial and territorial payroll deductions for all provinces and territories except Quebec. Withhold 765 of adjusted gross pay for Medicare and Social.

How To Use The Cra Payroll Deductions Calculator Blog Avalon Accounting

Paycheck Calculator For Excel Paycheck Payroll Taxes Consumer Math

Payroll Tax Calculator For Employers Gusto

How To Calculate 2021 Federal Income Withhold Manually With 2019 And Earlier W4 Form

Calculation Of Federal Employment Taxes Payroll Services

How To Calculate Payroll Taxes Futa Sui And More Surepayroll

How To Calculate Payroll Taxes In 5 Steps

Different Types Of Payroll Deductions Gusto

How To Calculate 2020 Federal Income Withhold Manually With 2019 And Earlier W4 Form

How To Calculate 2019 Federal Income Withhold Manually

What Are Payroll Deductions Article

How To Calculate Federal Income Tax

How To Calculate Net Pay Step By Step Example

Calculation Of Federal Employment Taxes Payroll Services

How To Calculate 2020 Federal Income Withhold Manually With 2019 And Earlier W4 Form

Withholding Taxes How To Calculate Payroll Withholding Tax Using The Percentage Method Youtube

Free Online Paycheck Calculator Calculate Take Home Pay 2022